Japanese Beef Markets 2011-2014

Japanese Beef Markets: Wagyu Price/Quality Segmentation

- Japanese Calf & Carcass Markets

- Japanese Wagyu Carcass Grade/Price Summary 2014

- Japanese Beef Carcass Prices 1990-2014

- Japanese Calf Markets

- Japanese Domestic Calf Market Performance 2011-2014

- Production/Price Trends FB JB Calf Market

- Review of Japanese Beef Dairy and Dairy Cross Calf Markets

Introduction

In contrast to the inadequate Australian beef chiller assessment program, the foundation of Japanese Wagyu quality leadership is a long established national meat grading system (JMGA), applied at wholesale level, by which individual carcasses are measured and ranked. Grading starts with breed type/sex, then measurement of meat qualities such as marbling, yield, meat colour & texture. A JMGA English-language web site here provides outline details of the system itself.

The system enables major quality and subsequent price differentiation between individual fullblood qualities and also differing livestock categories, such as fullblood vs crossbred (or F1), to which fullblood eating qualities – and therefore fullblood grades – do not apply. By defining a wide range of qualities for differing applications at a variety of price-points, the system ensures the broadest possible market (optimising market volume and producer opportunity), and because all market data is consolidated independently, accurate market analysis is also enabled. The result is comprehensive QA for domestic consumers and global food service buyers which ensures consistent customer experience with all Japanese Wagyu products.

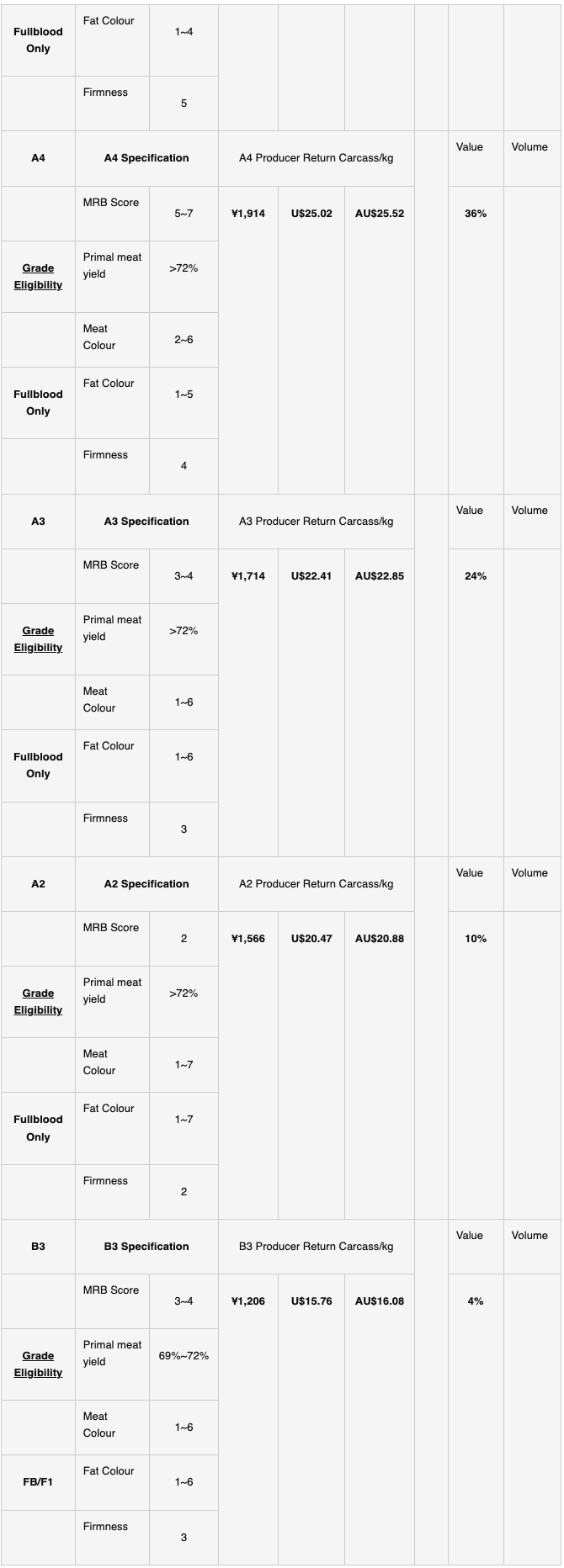

The Grade/Price Comparison table below depicts the JMGA system at work, demonstrating actual grade/price relationships in the Tokyo Meat Market in late 2014. As indicated by the ‘JMGA Grade’ columns, meat quality measurement extends far beyond ‘MRB score’. Yield is a critically important measure in an era of expensive cattle feeding programs, and by international standards Japanese Wagyu ‘Primal Meat Yield’ percentages are extraordinarily high.

Japanese Japanese Calf & Carcass Markets

Tokyo Meat Market: Wagyu Carcass Grade/Price Comparison, 2014.

(Click for larger picture).

The breed/price relationships above are worth consideration in the Australian context: a JMGA graded B3 Wagyu F1 (top grade for Holstein X), is worth a little over 50% of a premium fullblood A5 carcass on a per carcass/kg basis. Should Australian FB JB carcasses have a similar relation to Australian WY/AA F1 carcasses based on eating quality ? Is there good science to support the differences, or are we looking at an irrational Japanese phobia about their native cattle ?

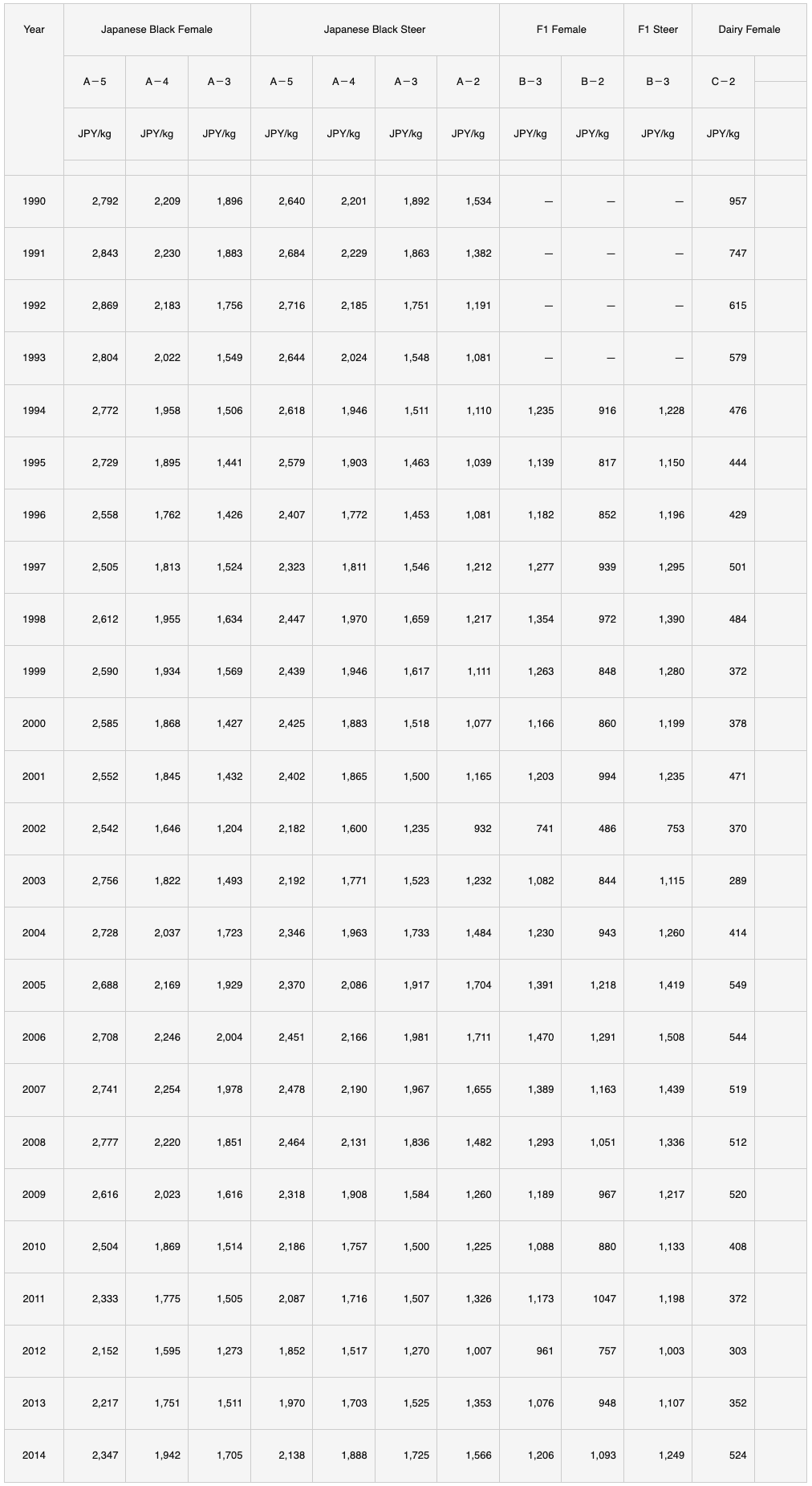

Japanese beef carcass prices 1990-2014

(Click for larger picture).

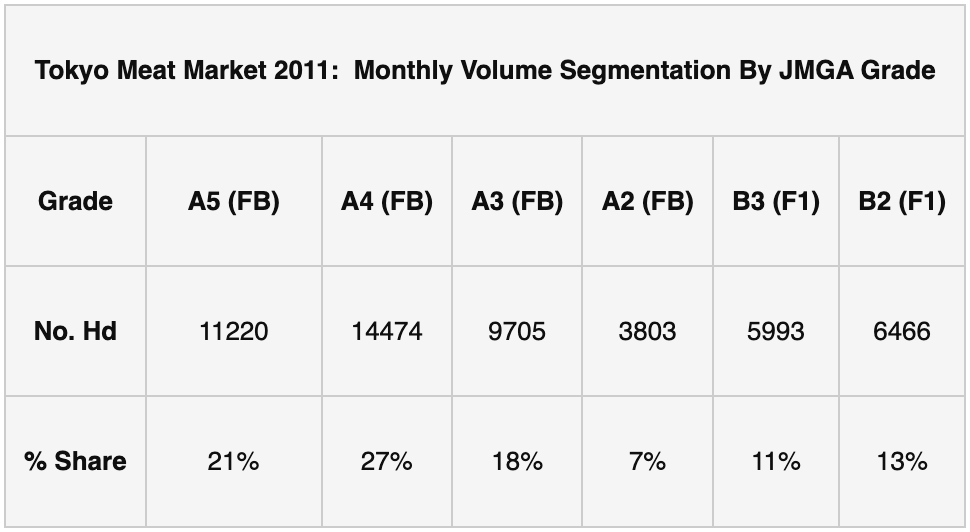

Regardless of eating quality science, from a quality assurance perspective, and for the most demanding chefs worldwide, the quality range within the JMGA system supports superior selection to anything available in Australia. In Tokyo, the largest quality/volume segment is usually A4. Following is a snapshot of comparative volume scaling by grade segments for an indicative period in 2011, followed by expanded Tokyo price detail for a range of JMGA qualities:

Indicative month segmentation by Grade/Livestock category based on 2011 MAFF data

(Click for larger picture).

Japanese Calf Markets

This subsection is based on Japanese Government (MAFF)livestock census data, which demonstrates that the key price/quality relationships in Japanese national feeder calf markets are defined by breeding as the key predictor for future JMGA grading value.

Domestic production only is considered. The volume and value of beef imported into Japan from Australia, NZ and the USA is not factored.

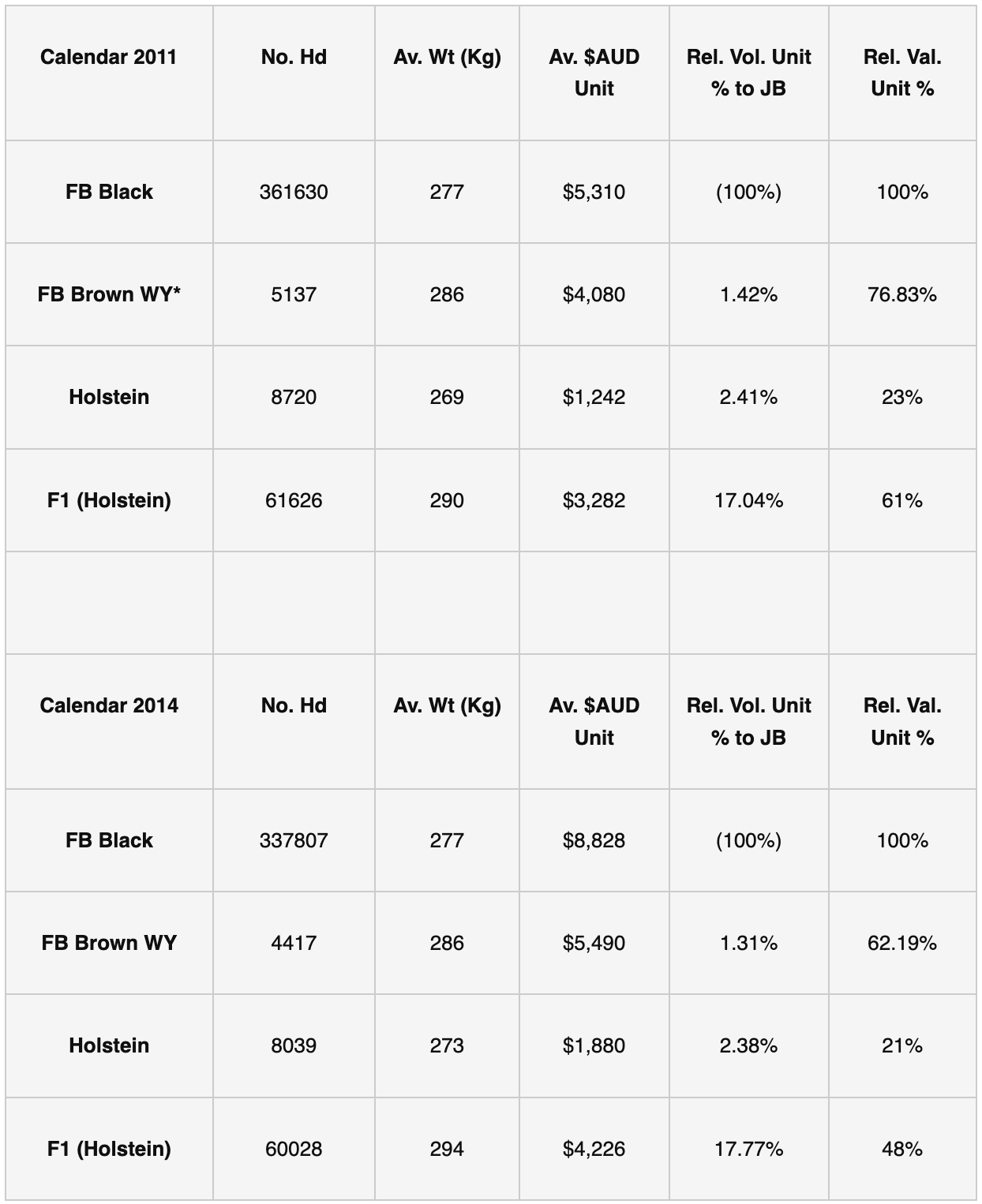

Total Japanese Domestic Calf Market Performance 2011-2014

(Click for larger picture).

As indicated above, fullblood Japanese Black feeders make up by far the greatest volume of sales. Greatest unit value, and increase in value over time is also achieved by Japanese Black in both real terms and compared with crossbred calves, although production has fallen slightly. Actual unit values and volumes of other important breed categories are shown both in actual terms and relative to Japanese Black pricing. Both ages and weights at calf market are similar across breeds.

Japanese Brown is the formal breed name for the two sub-breeds known as Red Wagyu in the West.

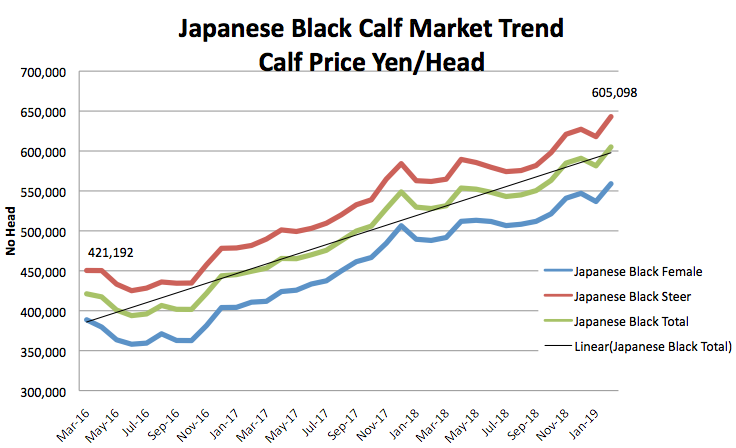

Production/Price Trends Japanese Black Calf Market

(Click for larger picture).

As indicated, despite aging farmer populations and other pressures, both actual FB Japanese Black production and the value of JB calves continues to increase.

Note that Holstein calf market volumes are not indicative of total production. Many Holstein feeder cattle are produced in vertical systems starting at calf rearing units and progressing direct to feedlots. Non-Holstein F1 calves are not traded in any of these markets.

Review of Japanese Beef Dairy and Dairy Cross Calf Markets

(Click for larger picture).

Summary

For the Western observer, the yawning gap in price relativity between FB Japanese Black and F1 Holstein calves must be a catalyst for consideration. Although the qualitative difference has not been measured in the West, it clearly exists for Japanese consumers. What has Western science missed ?

Let’s Talk About Your Wagyu Breeding Plan

We'll Find the Right Wagyu Breeding Solution for You

Call us: